Today's bitcoin price has broken the $ 9,000 threshold, accompanied by a plunge of the majority of other altcoins as the red enveloped the pace of decline.

The past hour has been very difficult when bitcoin from $ 9,200 plunged to $ 8,500, without any pull back from the bulls.

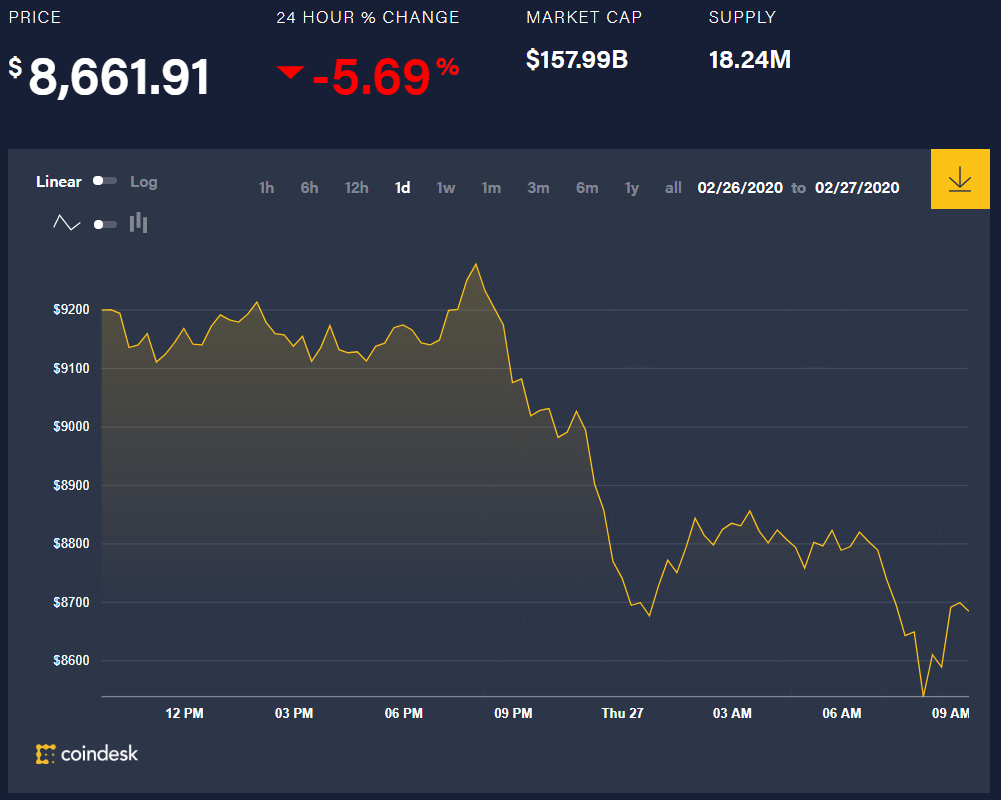

Today's bitcoin exchange rate (February 27) recorded at 10:00 at US $ 8,661, down 5.69% from the previous 24 hours.

For the past 24 hours, the lowest bitcoin price recorded at $ 8,530 and the highest at $ 9,283 – according to the CoinDesk exchange rate.

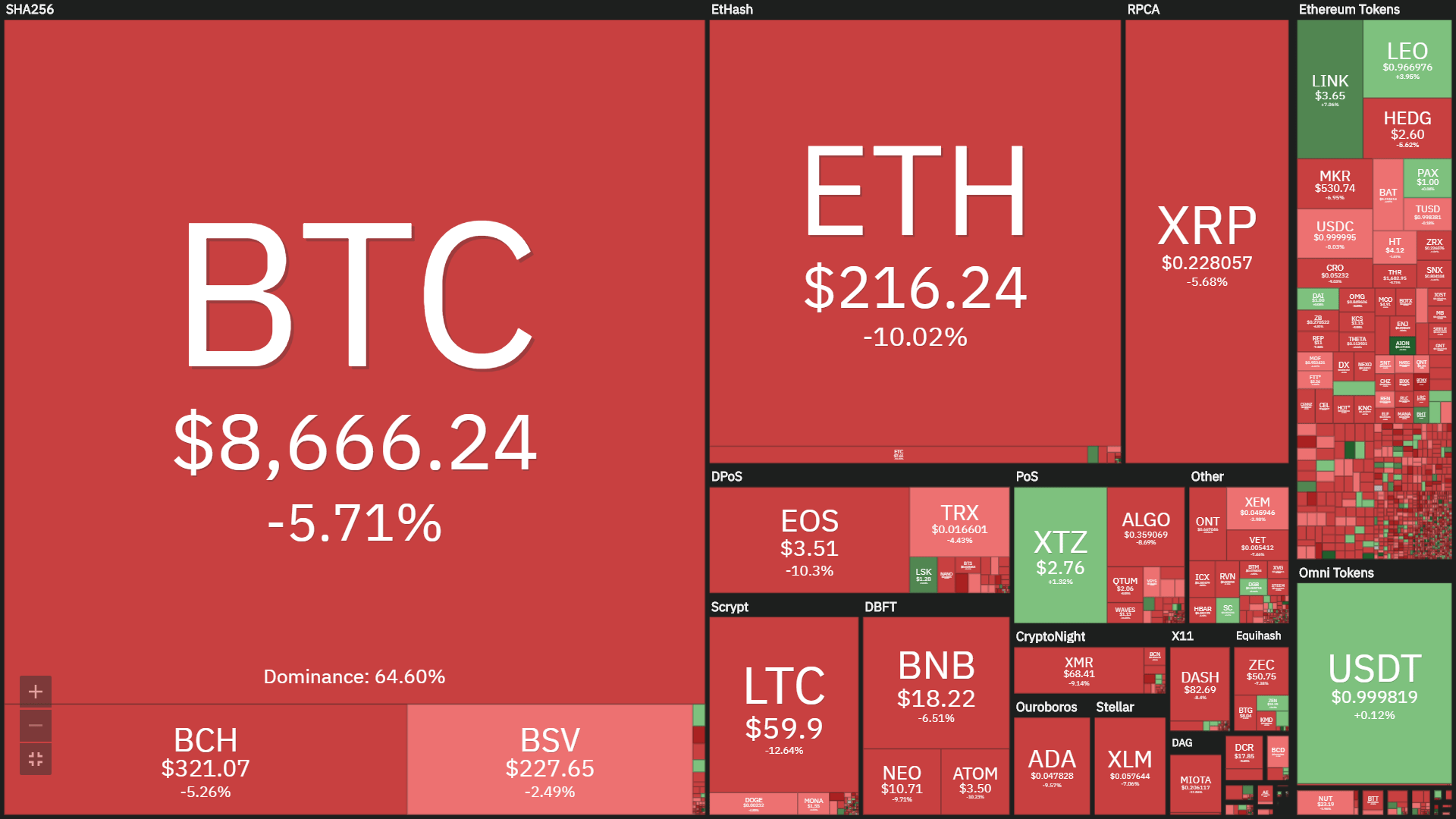

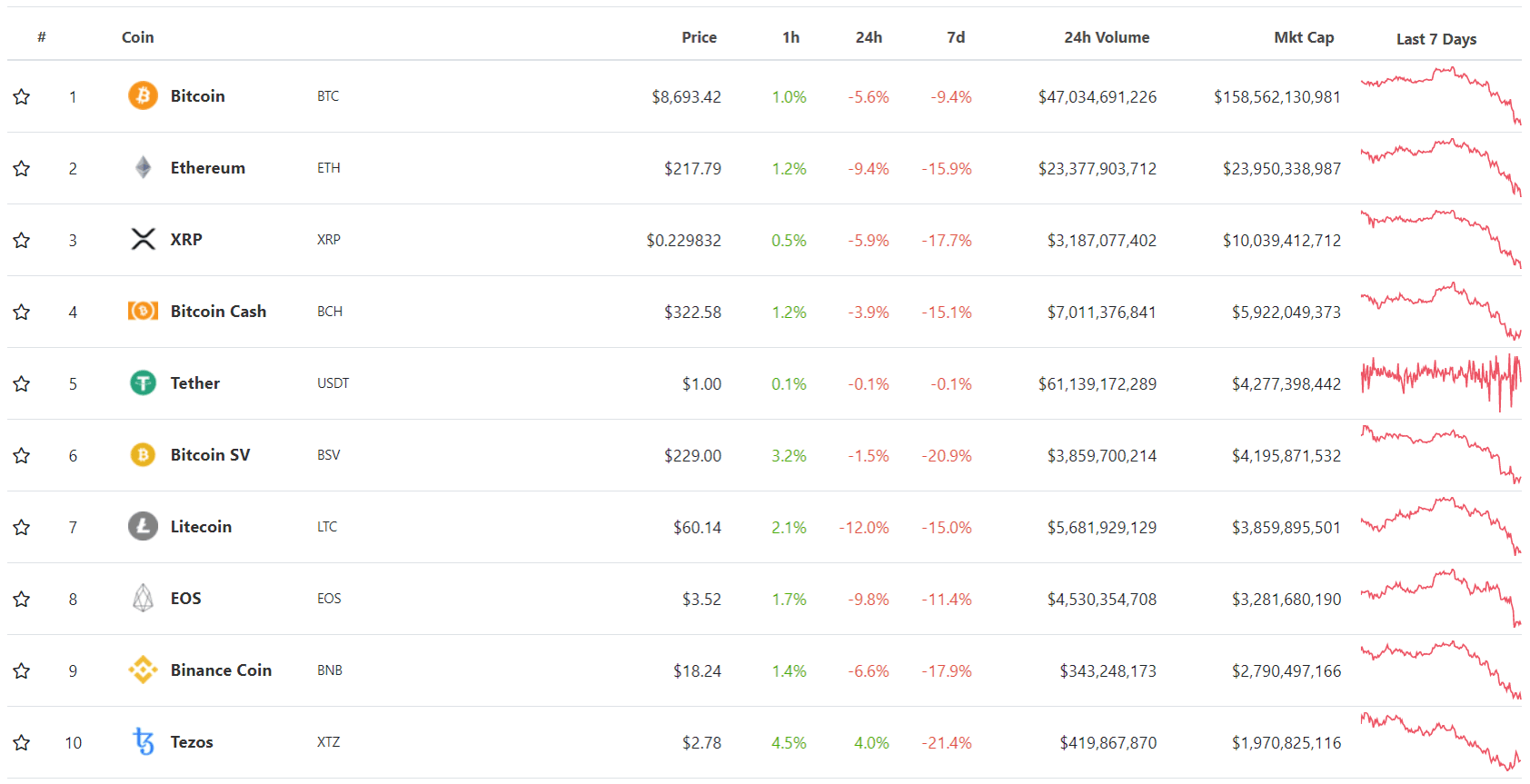

On the red market, there are 92/100 leading cryptocurrencies at market value off compared to the previous 24 hours.

In the top 10, there are 9/10 copper decreased compared to the past 24 hours.

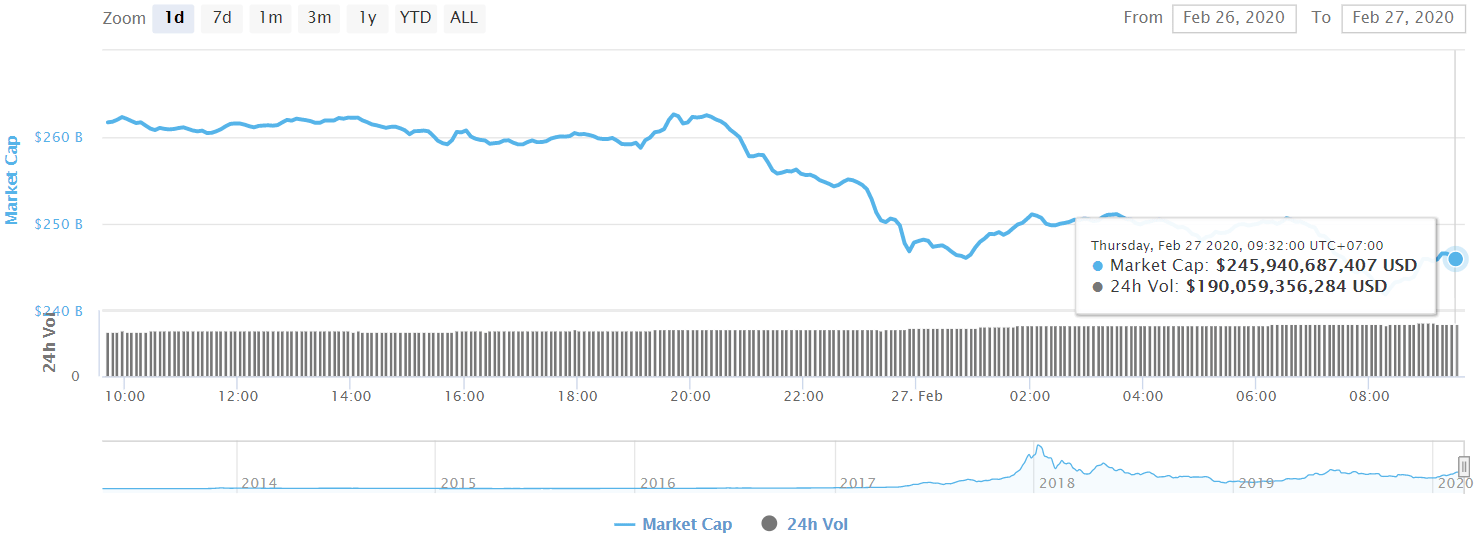

The total market capitalization of cryptocurrencies at 10am recorded at $ 245.94 billion, down $ 16 billion from the past 24 hours.

The volume of 24-hour transactions on the market increased to USD 190.05 billion, an increase of USD 29 billion compared to February 26.

Central Bank of Canada prepares for digital currency “when needed”

Although there is no immediate digital currency issuance plan, the Bank of Canada does not exclude this possibility.

BoK Deputy Governor Tim Lane spoke at FinTech RDV 2020 in Montreal, and affirmed that although there is no reference case for the national digital currency (CBDC) at this time, the bank is preparing an experiment and Consulting with various parties to design the national digital currency.

"The central bank will design digital currencies to bring the benefit of cash – secure, accessible, private and store good value, but in a consumer version can buy online or directly at the counter ".

The bank sees the potential for widely used private digital currencies to pose a threat to the Canadian currency. Mr. Lane added:

"If one or more alternative digital currencies threaten to become a substitute for CAD, then the central bank will issue digital currencies that can be used to protect the dominance of currency”.

South Korea proposes a 2-step plan for digital currencies

Tax experts at the Korea Tax Policy Association have advised the South Korean government on imposing low transaction taxes on digital currency profits before forcing people to pay income tax, according to Business Korea. reporting. The Korean government is expected to announce a tax reconstruction plan by the end of 2020.

Low transaction tax rates are recommended because of the lack of a legal basis for transaction taxes.

The Korea Blockchain Association agrees with this proposal: "The relevant legislation is still lacking and the tax base is still not sufficient to manage digital money, and therefore, there is still some cost. in the calculation ".