The past hours, prices Bitcoin still showed efforts to recover and grow from last week's fall, but the results are nowhere to be found.

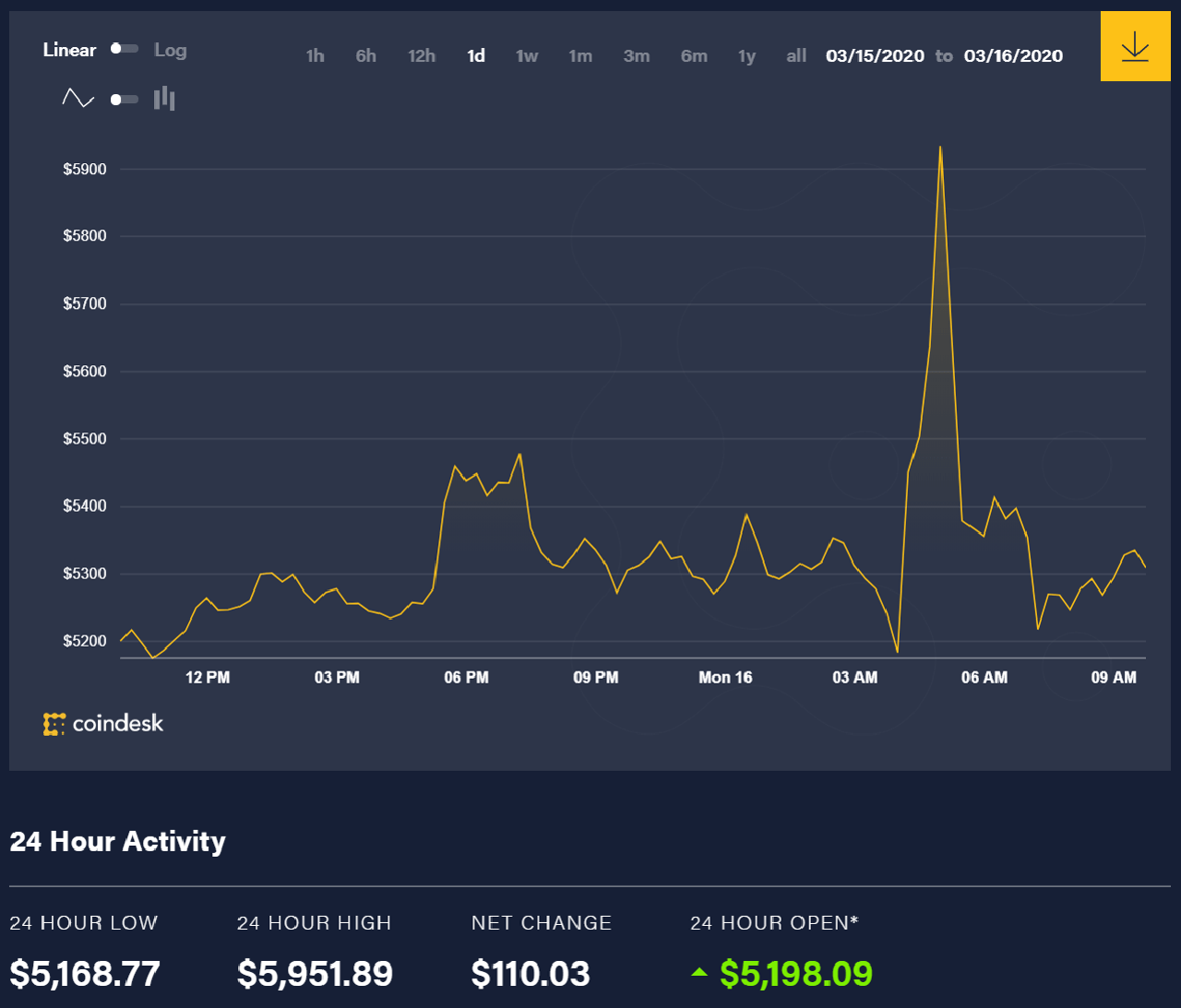

Bitcoin price movement in the past 24 hours mainly fluctuated around USD 5,200 – USD 5,400. Besides, other altcoins in the market recorded a slight increase.

Over the past 24 hours, the highest bitcoin price recorded at $ 5,951 and the lowest of $ 5,168, according to the Coindesk exchange rate.

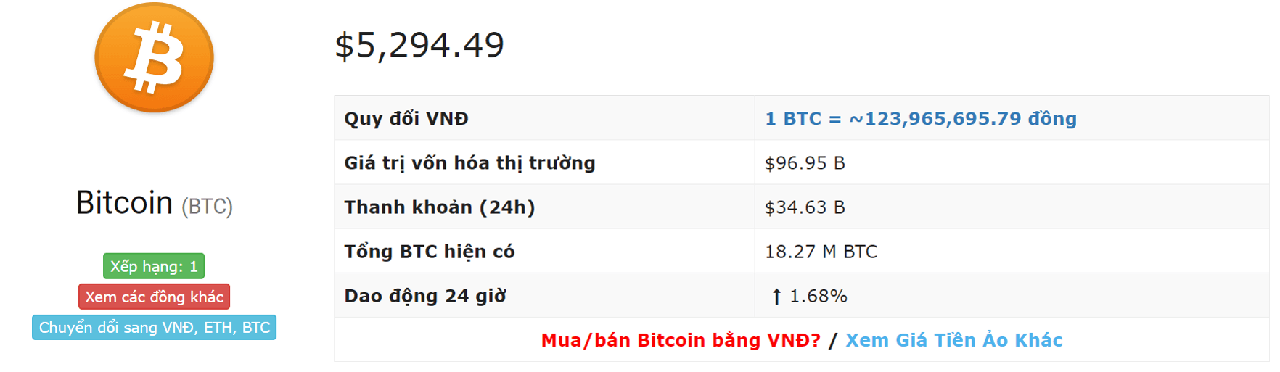

Today's bitcoin exchange rate at 10:10 at $ 5,294, an increase of 1.68% compared to the previous 24 hours.

Bitcoin's market capitalization has dropped to $ 96.95 billion, with Bitcoin's market dominance (market share) at 63.8% – according to the BTA's bitcoin exchange rate (https://blogtienao.com/ty-gia/BTC/bitcoin/).

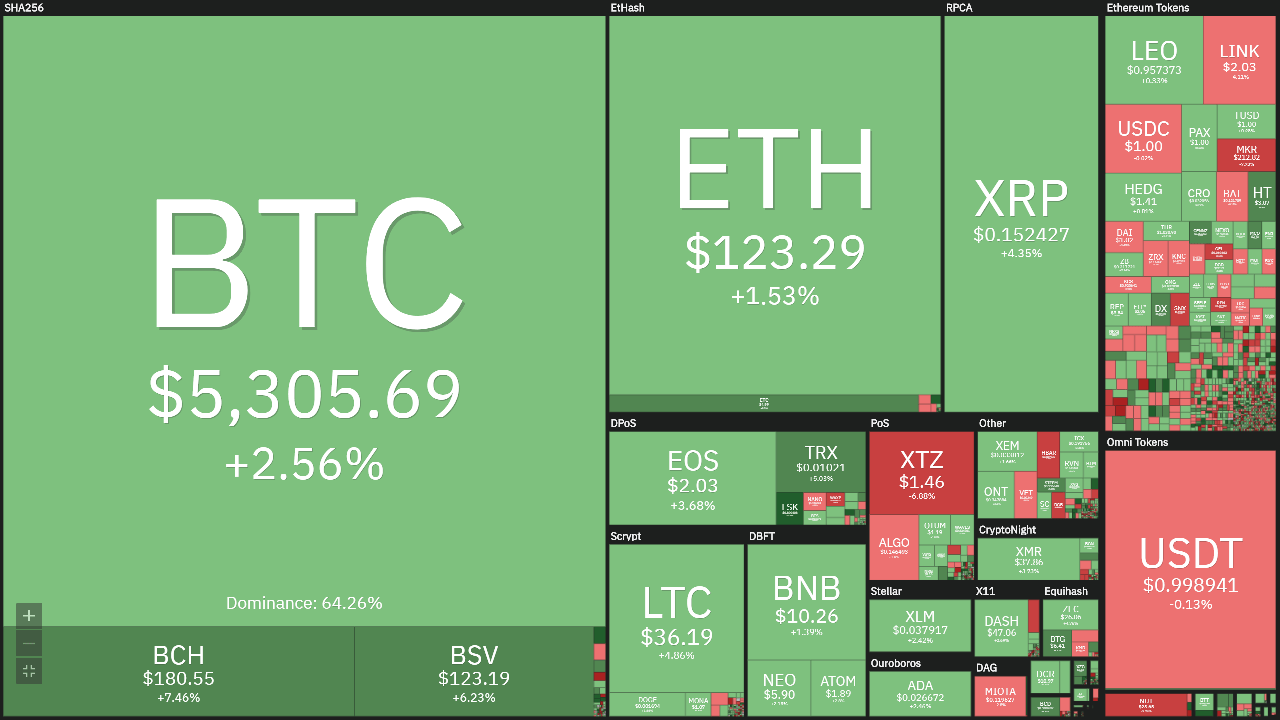

In the top 100, there are 69/100 cryptocurrencies by market value increased over the past 24 hours.

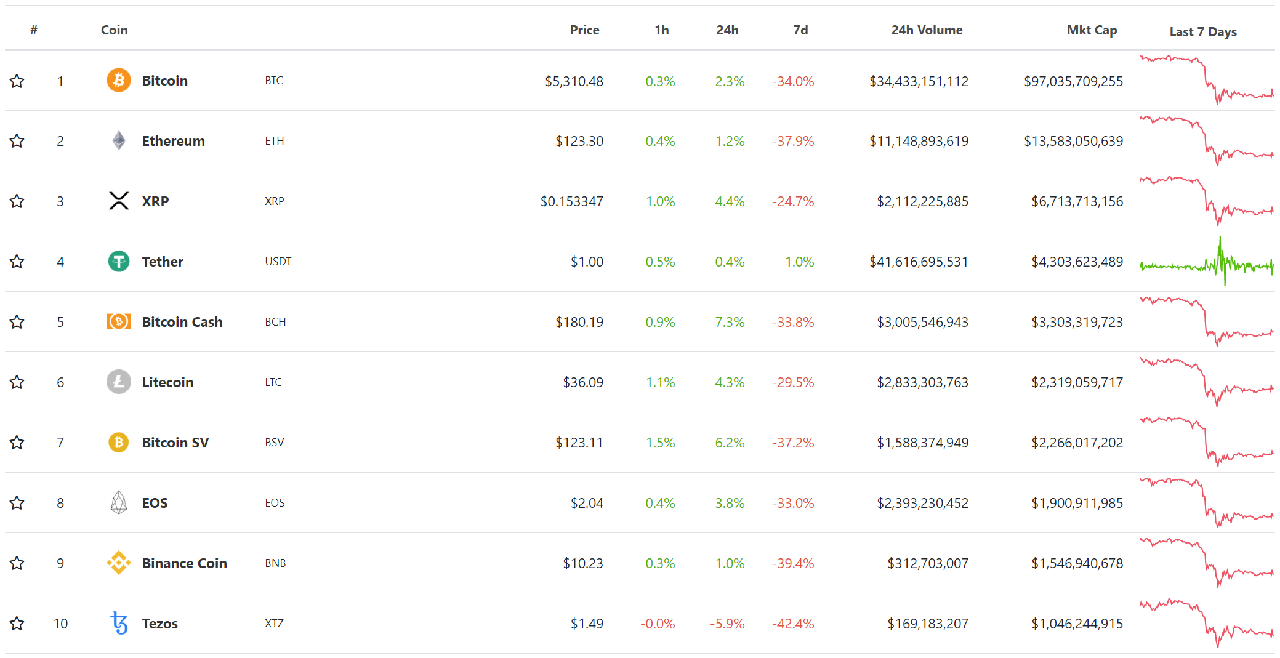

Today's Top 10 increased slightly compared to yesterday, with 9/10 VND increasing compared to the last 24 hours.

The movements in the past 7 days were quite negative, most of them recorded a decrease of over 30%.

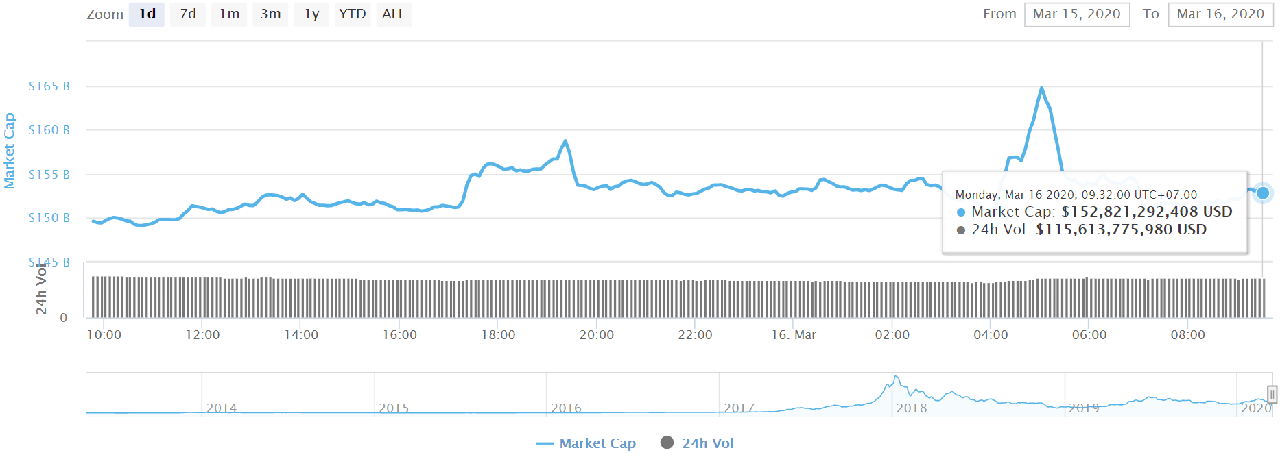

The total market capitalization of cryptocurrencies recorded at 10:10 at 152.82 billion USD, an increase of 3 billion USD compared to the previous 24 hours.

The 24-hour trading volume continued to decrease, recorded at 115.61 billion USD, 4 billion USD lower than on March 15.

Along BTA review the news available in the day, the content in the article will be updated as new news ..

USDC of Circle increased after the market went down

When bitcoin and the cryptocurrency market plummeted, people turned to stablecoins to keep their capital. Some stablecoins increase more than others.

Jeremi Allaire, co-founder and CEO of Circle, the company behind USDC, points out his company's stablecoin value to a new peak of $ 568 million after the market collapsed. He commented:

“While not as excited as seeing a market collapse, but still excited to see the entire blockchain-based monetary infrastructure on the rise, our stablecoins are operating effectively.”

Save 400 million USD / year with blockchain technology in air transport

Sita, a technology company in aviation communications and information, and ULD Care, a trade association, are exploring the possibility of using blockchain technology to save $ 400 million a year for the shipping industry. aviation, according to the announcement on 12/3.

The blockchain technology allows the air transport company to track and record changes to the storage of air cargo containers, or Air Transport Vehicles (ULDs), as goods move between locations.

These companies aim to reduce costs in the industry, increase efficiency, reduce losses and limit damage to goods.

The blockchain platform will also integrate validation and creditworthiness to reduce the risk of interference, computer crime, money laundering in commerce, and illegal transactions. Bob Rogers, vice president and financial manager of ULD Care, said:

"A container moving from Shanghai to Long Beach may take up to 30 days to complete the journey, but the actual travel time on the sea or on the road is only about 15 days, and the remaining time is spent on jobs. papers and office blocks. Using blockchain can innovate that process ".

Fed lowered interest rates to 0% and injected money 700 billion USD

After an extraordinary meeting on Sunday (March 15), the US Federal Reserve (Fed) announced lowering interest rates to 0% and implementing a quantitative easing program (QE) with $ 700 billion.

Futures contracts in the US derivatives market all fell sharply after the Fed's decision

Specifically, in a statement after the Sunday afternoon meeting (March 15 in US time, early Monday morning, March 16 in Vietnam time), the Fed said:

"The COVID — 19 epidemic has harmed the community and disrupted economic activities in many countries including the US. Global financial conditions are also significantly affected. "

In that context, the Fed decided to lower the federal funds rate from the target range of 1-1.25% to 0-0.25%.

The Fed said it will maintain the new low interest rate “until the economy is certain to overcome recent events and is on track to achieve full employment and price stability.”

After the Fed announced a series of monetary easing policies mentioned above, the US derivatives market fell to 5%, the Dow Jones futures fell more than 1,000 points.

At 7:40 am 16.3, the USD-Index on Kitco retreated to 97.88 points, down 0.59 points compared to the last session of the week. In contrast, the euro against the US dollar increased by 0.46% to 1,1161 and the pound to USD exchange rate also increased by 0.77% to 1,2372.

However, domestic USD exchange rate has not changed much.

*updating..